Chinese finance leaders’ experiences offer a way through the current crisis — from the need to protect cash to taking a broad commercial perspective.

中国企业财务领袖的战“疫”经验将为当前肆虐全球的COVID-19新冠病毒疫情危机中的企业运营带来实战经验,无论是现金流保护还是广泛的商业视角。

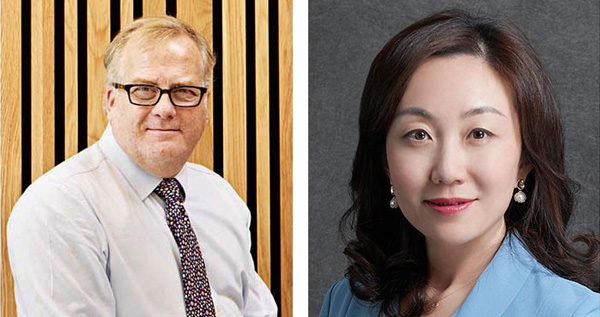

左:Andrew Harding, CIMA资深会员,CGMA全球特许管理会计师,国际注册专业会计师公会管理会计版块首席执行官

右:李颖,CIMA资深会员,CGMA全球特许管理会计师,国际注册专业会计师公会北亚区总裁

Finance professionals in many markets are playing a pivotal role in helping their organisations to navigate the COVID-19 crisis. The actions they take at this time, and the advice they give to management, can potentially make all the difference as to whether or not their organisation emerges from this crisis intact.

世界各地市场中的财务专业人士正在运筹帷幄,助力企业在COVID-19疫情中更好生存和发展。他们采取的行动,向管理层的出谋划策,可以对其企业从危机中重生发挥潜在的巨大影响。

When they are juggling so much, and have so much information to absorb, how can finance professionals ensure they are focused on the right priorities? Fortunately, they can learn from their peers in China who are now coming out the other side of the crisis. In a recent videoconference hosted by CIMA, eight members who are Chinese finance leaders shared their perspectives. Five important themes emerged:

财务人士们工作繁忙,有大量讯息需要吸收消化,他们如何确保自己总是将重心放在了正确的优先项上?幸运的是,世界其他地方的财务人士们可以从率先从这场危机中走出来的中国同行身上汲取经验。在近期由CIMA组织的视频会议上,8位身为公会会员的中国财务领导者介绍了他们的视角。五项财务必须关心的重要主题因此浮现上来:

Protect cash. “Cash is king” might be a cliché among finance professionals, but this cliché is now more relevant than ever before. The Chinese finance leaders that we spoke to emphasised that cash preservation was critical to enabling their organisations to survive. They explained that alongside the protection of people, the top priorities for finance professionals during this time should be to minimise spending, hold off capital expenditure, freeze headcount, and secure credit if it is needed.

保护现金流。 “现金为王”也许在财务人士中已是老生常谈,但这句老生常谈比以往任何时候都重要。受访的中国财务领导者强调,库存现金对企业生存至关重要。他们也解释道,在保护人员的同时,财务人士这段时期的首要任务是最小化支出、暂缓资本支出、冻结员工人数,并在需要时获得信贷。

Reprioritise. In a rapidly changing environment, it is essential that finance acts as a business partner to the organisation. This entails working with departments such as operations and marketing to refocus the organisation’s strategy and its marketing plans. Once finance understands how strategy has been affected by the crisis, it can help the rest of the business to ensure that money is spent in the right areas. It can also undertake financial modelling to support top-line growth.

调整优先项。在快速变化的环境中,财务人员能够承担起业务伙伴的角色,对企业非常重要。这需要和运营部门、市场部门通力合作,重新调整企业战略和市场计划。一旦财务人员理解企业战略在危机中受到了何种程度的影响,这将帮助业务部门确保将钱花在适当的领域,也可以进行金融建模,以支持营收增长。

Plan for different scenarios. No one knows quite how the COVID-19 crisis will play out, or what the nature of the recovery will be. On the one hand, we might see a sharp recovery and a fairly rapid return to business-as-usual conditions. On the other, there might be waves of infection later in the year that cause economic conditions to deteriorate further. In light of this uncertainty, finance professionals should plan for best-case and worst-case scenarios with regard to customer demand and sales, as well as the supply of raw materials. They will then be able to forecast how these scenarios could impact their organisation’s cash flow. It is also important to develop a list of actions to mitigate the risks that arise in different scenarios.

规划不同的场景。没有人知道COVID-19疫情危机会怎样结束,或是全球态势会怎样恢复。一方面看,我们可能看到快速的复苏,快速向业务常态回归。另一方面,今年后半段时期还是有感染卷土重来的可能,这将导致经济形势进一步恶化。鉴于这些不确定性,财务人士应该对客户需求、销量、原材料供应进行最优和最差情况的模拟规划。采取一系列行动,降低不同情景下可能导致的风险也很重要。

Wear a commercial hat. When confronting the COVID-19 crisis, finance professionals should take a broad commercial perspective and not focus solely

on cost cutting. That means helping to identify trends, such as changing consumer behaviours, or suggesting new products or services that could enable the organisation to develop innovative, digitally based revenue streams.

具备商业思维。直面疫情危机,财务人士应着眼广阔的商业视角,而不仅仅盯住成本削减。这意味着财务人士需要认清趋势,比如改变消费者行为,倡议能够支持数字化新产品新服务的营收来源。

Embed crisis-related behaviours in business-as-usual practices. The COVID-19 crisis has forced organisations to operate

differently — for example, by replacing face-to-face meetings with videoconferences. These new ways of working can be very cost-effective and good for organisational productivity. Finance professionals should consider how they can embed them within their practices in a post-crisis world. For example, should they recommend that, going forward, staff cut back on nonessential travel and work from home, at least some of the time? This might help the organisation to control better its costs during the recovery phase.

在常规商业活动中融入危机处理的行动。疫情危机迫使企业采用不同以往的方式运营,例如,用视频会议替代面对面会议。这些新型工作方式也可以非常高效,利于企业生产力。财务人士需要考虑在后疫情时代如何有机结合这些新型工作方式。例如,财务要不要进一步建议员工削减不必要的差旅,甚至在某些时候在家办公?这可能会帮助企业在复工期更好地控制成本。

Clearly, the workload and pressures involved with crisis management make this a very challenging period for finance professionals. As our Chinese finance leaders showed, however, this period can also enable them to shine. By helping their organisations withstand the current crisis, finance professionals will derive personal satisfaction from making a difference and further enhance their reputation as business partners.

对财务人士而言,这个特殊时期带来的与危机管理相关的工作和压力非常具有挑战。中国财务领导者表示,机遇与挑战并存。在帮助企业历经风雨的同时,财务人士也将从中获得个人成长,进一步提升作为业务合作伙伴的声誉。

For more news and reporting on the coronavirus and how management accountants can handle challenges related to the outbreak, visit FM’s coronavirus resources page.

更多关于新冠疫情下管理会计师如何应对挑战的新闻和报道,请访问FM专题页面coronavirus resources page。